Money and finances. It can be an uncomfortable and even polarizing topic of conversation between your spouse, your family and your friends. Yet money impacts every single one of our lives. Smart finances are a topic I have become passionate about; specifically, saving for retirement.

The best “saving for retirement” advice I ever received was this: “Cars can have loans. Houses have mortgages. Children’s schools have scholarships. No one is going to give you a scholarship for your retirement. Don’t forget to pay your future self.” This stuck with me as a new college grad who was figuring out life, and bills, with her first new “grown-up” paycheck.

The military spouse who dished out this advice didn’t mean to forget to save for a shopping spree or a Tesla or a Caribbean cruise. She meant to save for your future living expenses so you can enjoy your old age and your family while eventually limiting work hours or not working all together.

Couples have different means of managing finances and it is important to explore which way works best for your own life. When my husband and I got married, we decided that our incomes would become one family pot of money and all of our debts and bills would be split between that one pot. This ideology works for us because it puts us on equal financial playing fields, and we tackle money as a team.

Now, this doesn’t mean that my husband and I spend 100% of our paychecks perfectly every time. We are working to pay off student debt and car loans while in the midst of buying our first home. Among these big purchases, we work daily to make smart financial decisions to get us closer to the financial future we hope to attain.

“Smart financial future” means something different to everyone and may even change as life progresses. For us, a smart financial future means we are debt-free, save as much as we can for retirement and set our family up for a happy life. In the past few years of being a military family, my husband and I have come up with a few of our most important financial tips:

- Be smart with your purchases. If you don’t need it, don’t buy it. Just because it is on sale doesn’t mean it is a good deal. (This one I struggle with.)

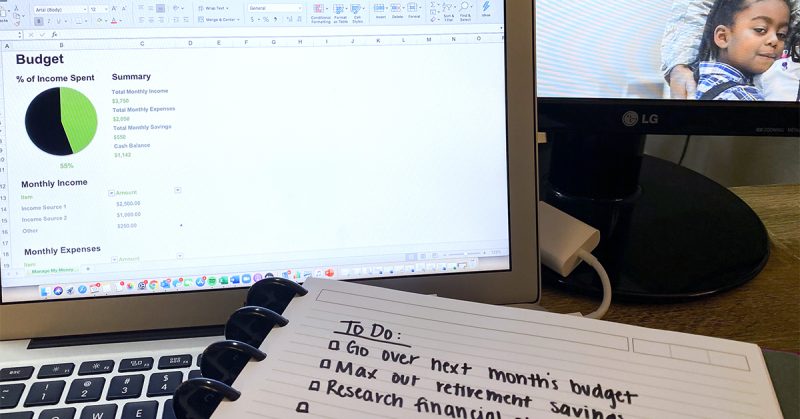

- Have a budget you and your spouse agree to. My husband and I have a budget we work with including bills, groceries, gas and extracurriculars. Part of our budget is how much extra we want to put towards our debt to try to pay it off early. It is also just as important to review your budget often and make sure it is realistic and being followed to the best of your ability.

- Pay off your debt as quickly as you can. The more debt you owe to loans or credit cards, the less money you’ll have to pay yourself. Put any extra dollar at the end of the month towards your debt to help pay it off early.

- Live by the 50/15/5 rule. A good rule of thumb is: 50% of your take-home pay should go to bills, 15% of pretax income should go to retirement and 5% of take-home should be put in a personal savings/rainy day fund. Set up personal savings to come out of your checking account automatically so you don’t even have to think about it. You can even set up the automatic payment to be made the same day you get paid so you don’t see the money in your checking account and it goes straight to your savings!

- Save for retirement as early as you can. Remember: No one is going to give you a scholarship for your retirement. Don’t forget to pay your future self.

- Bonus tip: Find a financial planner. I am a huge proponent of having a financial planner who can advise you on what you should be putting in savings, where you can smartly invest (or even if it is smart for your situation to invest), how to pay off debt and how to manage your budget. If you and your spouse decide to hire a financial planner, I personally find it critical that this person is extremely familiar with the military pay system. While my husband was deployed, we sat down with our advisor and he reworked our budget to include my husband’s new pay after his promotion and any extra deployment payments he would be receiving.

Military OneSource has a number of resources and articles on money management, as would your local duty station. The best thing you can do for your future self is to make smart financial decisions that set you up for success. But first things first: What does smart financial success look like for you?

Excellent article. I have seen a few areas that I have been neglecting.