Note: On March 21, 2020, the IRS announced the tax filing deadline has been extended to July 15, 2020 due to COVID-19.

Benjamin Franklin famously claimed there were two certainties in life – death and taxes. If Franklin were a military spouse, he would have said they were moving and complicated taxes.

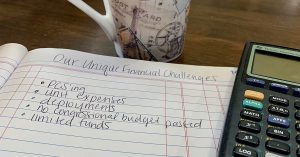

Filing taxes as a military spouse can be daunting because of all of the variables. Perhaps you own your own business where you are stationed, or maybe you’re a virtual assistant for several clients across the country. In addition to contributing to your family income, you and your service member are stationed in Kentucky, your home of record is New Hampshire, you had a baby this year, bought a car, and to top it off – your husband is deployed. How do you begin to organize this chaos? How do you ensure you file properly and take advantage of all the tax credits available to you? Not knowing what step 1 was, I looked to Military OneSource for their help.

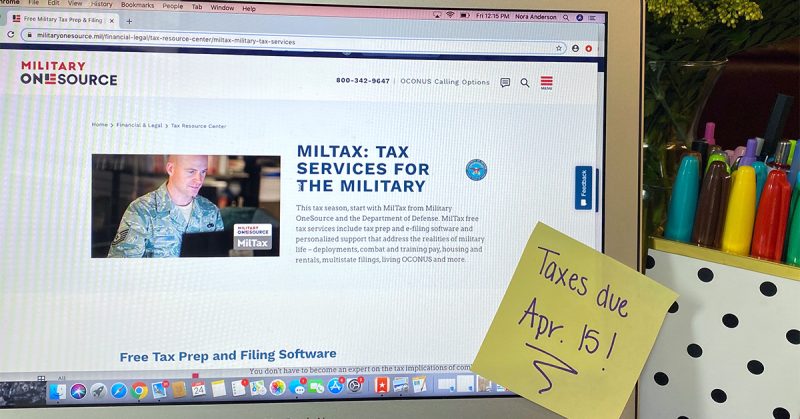

Military OneSource created a “one-stop shop” to file taxes – MilTax . MilTax is split into two offerings. The first option is access to a free tax prep and e-filing software. It is thoughtfully designed to address military-specific needs and calculations are 100% accurate, guaranteed by the software provider. This is a great spot to jump in to if you have a solid idea of what you are doing or have a simple return. If you’re completely at a loss of where to start, or have specific questions along the way, Military OneSource also has tax consultants who are trained to guide you through these unique tax situations. Examples of these topics include: navigating the new tax code; reporting deployment pay; tax forgiveness and refunds for survivors; extensions and deadlines; and more. MilTax services are 100% free with no hidden surprises. Typically, access to preparation software and support like this can cost more than hundred dollars.

The first thing I did when I sat down to do my taxes was navigate the Blog Brigade site to read blogs other service members and spouses had written about their troubles and solutions. After collecting all of the paperwork I knew I would need and reading about the new tax laws, I gave the MilTax consultants a call to make sure I was squared away. My biggest question was determining which state I filed under. The consultant explained that in 2009, Congress passed the Military Spouse Residency Relief Act (MSRRA). This enabled military spouses to maintain their state of residency even after they PCSd (if they were on orders with their service member). MSRRA made sure spouses were not double taxed. For me, even though I now live in Kentucky, New Hampshire is my home of record and is where I will pay income tax. After determining this, the rest of the process was straightforward and simply a matter of answering all the questions the tax software pushed out. Did you have a baby? Did you buy a home? Did you buy a car? All questions anyone unsure about doing their taxes will feel confident answering.

So … take a deep breath, sit down and get something major crossed off your to-do list. Taxes aren’t going away, and Military OneSource has all the tools and content to make filing feel a little less complicated. We got this!