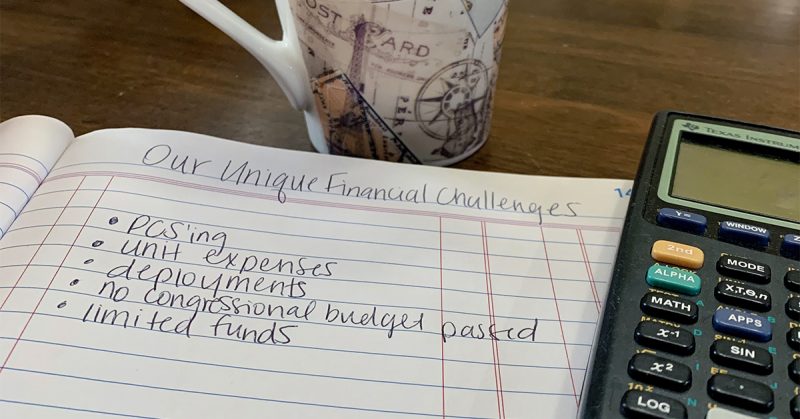

It’s no secret that military families experience their share of unique financial challenges. PCSing, unit expenses, deployments and limited funds are a few of the challenges we face as military families, and financial stress affects all of us at one point or another.

Financial stress is one of the most common issues couples fight about. Some things we have no control over, but other things we can anticipate. PCSing can fit in either category, because finding out on a dime that you’ve been given orders to a different post can and does happen too often. But most of the time, we have an idea of when the next PCS will happen.

The best thing to help your family anticipate the upcoming financial burden is to prepare. It’s a great idea to put as much money into an emergency savings account as possible before a PCS so you have a safety net during the process. We get reimbursed for moving costs, but there can be many unexpected costs resulting in a temporary loss of money. Another idea to help put some money away is to sell the items you don’t need or use anymore. Having a garage sale can be a great way to make some extra money.

Deployments are sometimes quite a burden too. When my husband deployed to Korea, it meant he wasn’t going to get hazardous duty pay, it wasn’t tax-free, and because it was a shorter deployment, he didn’t get cost-of-living adjustment (COLA). They had a dining facility for him to eat in, but his work hours didn’t allow him to use it. So, we were basically supporting two households and it was a big financial stress. His deployment to Afghanistan, on the other hand, had different circumstances and allowed him to bring home income.

But, in either case the most important thing is to have a plan. A fun way my husband and I stayed connected during one of his deployments was to come up with a vacation we wanted to take after the deployment. We saved for it with the extra money he made on the deployment, and it was a great conversation we had throughout his time away.

Unit expenses are something my husband and I never considered until his first command, and they added up quickly. We came into a Soldier, Family, Readiness Group situation that had very few informal funds, so we ended up paying for a lot of group-related things out of pocket. Even if you aren’t going into command, some units can be expensive. There are gifts, meals, fundraisers, hail and farewells, luncheons, and regular uniform expenses. If you are headed into any type of leadership position in a unit, I suggest coming up with a list of financial factors that might come along with the position and make room in your budget.

One stress that we’ve had a few times now is the fear of not getting paid when Congress doesn’t pass a budget. A month without pay would substantially impact any family, even if you are paid back afterwards. Building up a savings account that you could live off for three to six months if something did happen to your income can alleviate a lot of uncertainty.

Financial readiness is an important aspect of family readiness in the military. We didn’t choose this life for the money. Planning, budgeting and saving becomes especially important as we face many unique financial challenges. Being as prepared as we can be will enable us to live this life without as many financial stressors.

hello katelyn, my name is yvonne. I AM Trying to find some one who can help find the answers i so despertly seek. i found this site and i liked your blog. i need your help PLEASE! ITWOULD BE EASIER TO EXPLAIN WHAT I NEED HELP WITH IF YOU COULD SEND A RESPONSE T0 MY E-MAIL? PLEASE IDO NOT HAVE A COMPUTER,JUST THE INTERNET FOR NET FLIX. IM USING THE SEARCH FOR AKEYBOARD. IHAVE EMAIL ON MY CELL. I NEED IMPORTANT INFORMATION ABOUT MY SPOUSE IN KABUL I CANNOT LOCATE HIM. CAN YOU HELP.

Hi Yvonne, please call the Military OneSource call center at 800-342-9647 for personalized assistance.