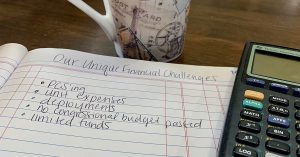

It’s no secret to military families that finances can get tight. We have some unique financial considerations. It’s expensive to move often, prepare for deployments, and replace uniforms unexpectedly. Yes, we have had pens go through the washing machine with uniforms at our house. Yikes!

When I married my husband, we had a lot of debt holding us back from reaching our goals. No traditional wedding, no honeymoon, and no-frills! We moved into our first apartment without being able to buy much furniture for the first couple of years. Money got even tighter when I went back to school. Plus, we were feeling the effects of spending our money before we had even earned it.

Luckily, we got organized early on and paid off more than $50,000 in debt in the first 3 years of marriage. I’m no expert, but I learned a few things on our journey that might help you to get started.

1. Start Small. What can you do to save a little money today? Selling stuff that you already have can help to kick start your plan. When we started our plan, we sold some of our belongings to take a little financial pressure off. We sold a computer, a camera, a guitar, and even our dining room table. While you may not want to go that extreme, there is always a way to save! Make coffee at home this week instead of grabbing it on the way to work. Do your own nails instead of visiting the salon. Pack your lunch. Tiny decisions add up to big rewards. We visited the commissary at the beginning of each week with a budget in mind and a shopping list in hand. Your money will stretch if you set a budget, buy only what’s on your list, and eat at home.

2. Gain Perspective. What’s your weakness? Eating at restaurants when you’re too tired to cook? Online shopping when you’re bored? I challenge you to add up the total cost of what you spend per month in each category of your finances. We were shocked to see that a huge chunk of our money went to restaurants. Adding it all up can help you figure out where you need to start your plan. Many banks offer free tools in their online services that can do those calculations for you. Plus, there are free Military OneSource calculators and budget guides that you can use.

3. Be Accountable. It’s easy to get off track if you don’t prepare beforehand. Failing to plan is planning to fail. Take inventory of all of your bank accounts, debts, and goals. Write everything down. You’ll need that information to make an accurate budget. At the end of each week, I created a summary of our finances and gave my husband an update on where we stood. It’s motivating to see what is going well and helpful to see where you need to make a change.

4. Be Realistic. Know that it will be hard. I worked full-time and went to school full-time during our payoff plan. Some days it felt impossible, but it was worth it to not feel the weight of student loans after graduation. Remember that it will be worth more since you worked so hard for it. Also, remember to make a “for fun” category of your budget. If you don’t, you might get frustrated and give up before you really see results! It helps to have something fun to look forward to.

5. Set Expectations. When holidays, birthdays, and anniversaries come around, it can be easy to get off track. Set expectations for your family ahead of time. This will save you from possible disappointment. Sit down with your partner and have an open conversation about your financial goals. When we started our plan, we agreed that we wouldn’t buy extras and fancy things whenever we could help it. This meant that for our second-anniversary dinner, we enjoyed a sub sandwich picnic and took a walk together at a free nature trail. Funny enough, it was one of our most memorable dates.

If you’re at the beginning of your journey to financial freedom, please don’t be discouraged. It’s hard, but it’s worth it. You might even gain some other benefits along the way. During our quest to eat at home as much as possible, my husband discovered a love for cooking from scratch. During our quest to find free activities on the weekends, we visited some amazing outdoor spots that we wouldn’t have seen otherwise.There are tons of personal finance resources available to you through Military OneSource. Take advantage of them and don’t be afraid to ask for help! You can speak with a consultant and access exclusive content on military finances.

Remember: You can do this! What’s your favorite money-saving trick? Share it in the comments below!