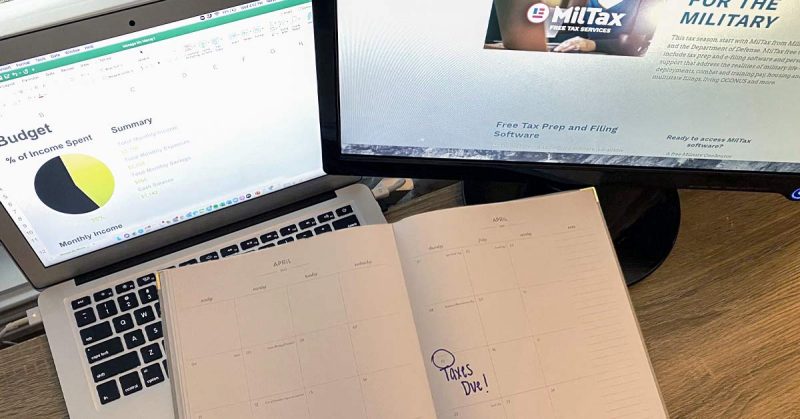

Filing taxes as a MilSpouse can be a daunting task because of all of the variables that contributed to the last year. As if 2020 wasn’t treacherous enough, completing your taxes for the year is sure to throw a wrench in the plans. Many military families received stimulus checks and service members had taxes withheld from their paychecks for a period of time. This leaves many military families wondering where to begin when it comes to filing their taxes by April 15. Luckily for us, Military OneSource has created a seamless, easy and free way for military families to file their taxes.

MilTax: Free tax services

MilTax is a one-stop shop to file taxes. This is where you will start when you go to file. MilTax services are split into two categories depending on your needs.

Free tax prep and e-filing software

The first option in the MilTax suite of services is access to a free tax prep and filing software. Typically, access to software like this can cost up to several hundred dollars. The industry-leading tax service provider has thoughtfully designed software to address military-specific needs, and calculations are 100% accurate, guaranteed by the software provider. This is a great spot to jump into if you have a solid idea of what you are doing. This platform is available from mid-January through mid-October.

Military tax consultants

If you’re completely at a loss about where to start or have specific questions along the way, Military OneSource also has MilTax consultants who are trained to guide you through these unique military-specific tax situations. Examples of topics MilTax consultants are trained on include: navigating the new tax code, reporting deployment pay, tax forgiveness and refunds for survivors, and extensions and deadlines. They can also assist you with any questions you might have related to navigating the COVID-19 economic impact payment and more.

Where do I file?

My toughest question every year is, “Where do I file?” I live in Tennessee, have New Hampshire as my home of record and have clients from all over the country. I always confirm with MilTax consultants to make sure I am squared away. The consultant explains that in 2009, Congress passed the Military Spouse Residency Relief Act. This enabled military spouses to maintain their state of residency even after they PCSed (as long as they were on orders with their service member). MSRRA made sure spouses were not double taxed. For me, even though I now live in Tennessee, New Hampshire is my home of record and is where I will pay income tax. After determining this, the rest of the process is straightforward and simply a matter of answering all of the questions the tax software pushes out. Did you have a baby? Did you buy a home? Did you buy a car? All questions that anyone unsure about doing their taxes will feel confident answering.

After many years of using the resources and programs Military OneSource offers for free, I highly recommend everything they offer. So…take a deep breath, sit down and get something major crossed off your to-do list. Taxes aren’t going away but Military OneSource provides all the tools and content to make filing feel a little less complicated.